Samuels & Parker say they are specialists in Bordeaux but their home page features a cropped version of a photo of a New Zealand Sauvignon Blanc vineyard – see here.

'Formed by a group of experienced and successful wine traders, Samuels & Parker are providing an opportunity for our clients to gain a foothold in the thriving and prosperous fine wine market.'

'We are committed to ensuring our clients receive the best market knowledge and access to opportunities that have only been available to a select clique. It is our fundamental objective to ensure complete customer satisfaction with our range of services and products.

Our entire team are extremely experienced and have an exemplary depth of knowledge and performance within the fine wine market – many forming long term relationships with our clients.

'At Samuels & Parker, we have built a business on the basis ....'

'At Samuels & Parker, we have built a business on the basis that many

independent financial commentators believe fine wines deserve

consideration as part of a comprehensive collecting strategy. A holding

in fine wine is part of the diversity argument.'

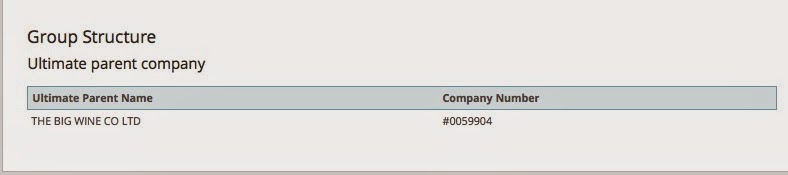

The guff on the Samuels & Parker website sounds impressive! Even more impressive when you realise that the company wasn't formed until 9th September 2014. Its sole director is 27-year-old Lewis Samuels (DOB – 7.10.1987). Samuels is also the sole shareholder of Samuels & Parker Ltd with £100 of share capital. The company was initially registered at 16 Rayfield Close, Bromley BR2 8JT.

The mention of Bromley and investment is so reassuring!!

On 18th November 2014 Samuels & Parker Ltd's registered office changed to 3 More London Place, London SE1 2RE. These are serviced offices and this is given as their trading address.

Addresses in Central London and Hong Kong

– both serviced offices

Regus serviced office @3 More

Serviced offices at Level 10, Hong Kong

Lewis Samuels and Samuels & Parker Ltd appear to specialise in offering to sell wine for their clients – nothing wrong in that except there is a nasty catch.

At the beginning of the year one client (AG) was persuaded to transfer some 36 cases of fine wine, worth some £80,000, that was in-bond to Lewis Samuels. Samuels told AG that he had a client in Hong Kong who wanted to buy the wines in time for the Chinese New Year. The wines went into Lewis Samuels' private account. Samuels & Parker Ltd does not have an account at this bond.

Once the wines were in Lewis Samuels' account they were immediately transferred to another UK bonded warehouse. Very soon AG had doubts and tried to get his wine back/get paid for it. Despite AG chasing for payment to date he hasn't received a penny. And the wine? He was told it was now in Hong Kong but – quelle surprise! – the Chinese client no longer wants the wine! Samuels & Parker Ltd could, however, told AG that they could fly his wine back from Hong Kong at a cost of £9200!

Clearly Lewis Samuels is both a joker and a chancer as it is highly unlikely that AG's wines ever left the UK. Their alleged journey to Hong Kong is as fictitious as the Chinese client.

Curiously AG received a broking list from Samuels & Parker Ltd called: 'Samuels & Parker Ltd Wine Stock 2015'. However, it is Corney & Barrow's broking list. As agents for DRC and Pétrus among others, Corney & Barrow would have nothing to do with the likes of Mr Lewis Samuels. Doubtless another instance of Lewis' sense of humour!

'Samuels & Parker Wine Stock 2015'

actually no – Corney & Barrow's list!

You might wonder why it is Samuels & Parker. I assume that Lewis added the Parker name hoping for additional gravitas and credibility from the famous American wine critic – Robert Parker. The great man happens to be in London this week. Whether Robert will welcome any linking, however tenuous, with Lewis Samuels is quite another matter – highly unlikely I would have thought....

I understand that AG has reported Lewis Samuels and Samuels & Parker Ltd to Action Fraud. I hope the police can intervene before Lewis Samuels turns magician and makes AG's wines disappear.

I understand that AG has reported Lewis Samuels and Samuels & Parker Ltd to Action Fraud. I hope the police can intervene before Lewis Samuels turns magician and makes AG's wines disappear.

Clearly Samuels & Parker Ltd is one to watch out for and, as far as I'm concerned, avoid.

The moral of this story is clear – do your due diligence properly before transferring your wine portfolio into someone else's account.

Very good to see UK bonded warehouses cooperating here!

Very good to see UK bonded warehouses cooperating here!

Update: 26th February 2016

Samuels & Parker Ltd was dissolved on 23rd February 2016 as its annual return was never filed. I understand that AG died in December 2015. He never received any money for his wine that he transferred. Furthermore in October 2015 he was persuaded to to send money, which I understand also disappeared without trace.